deferred sales trust cons

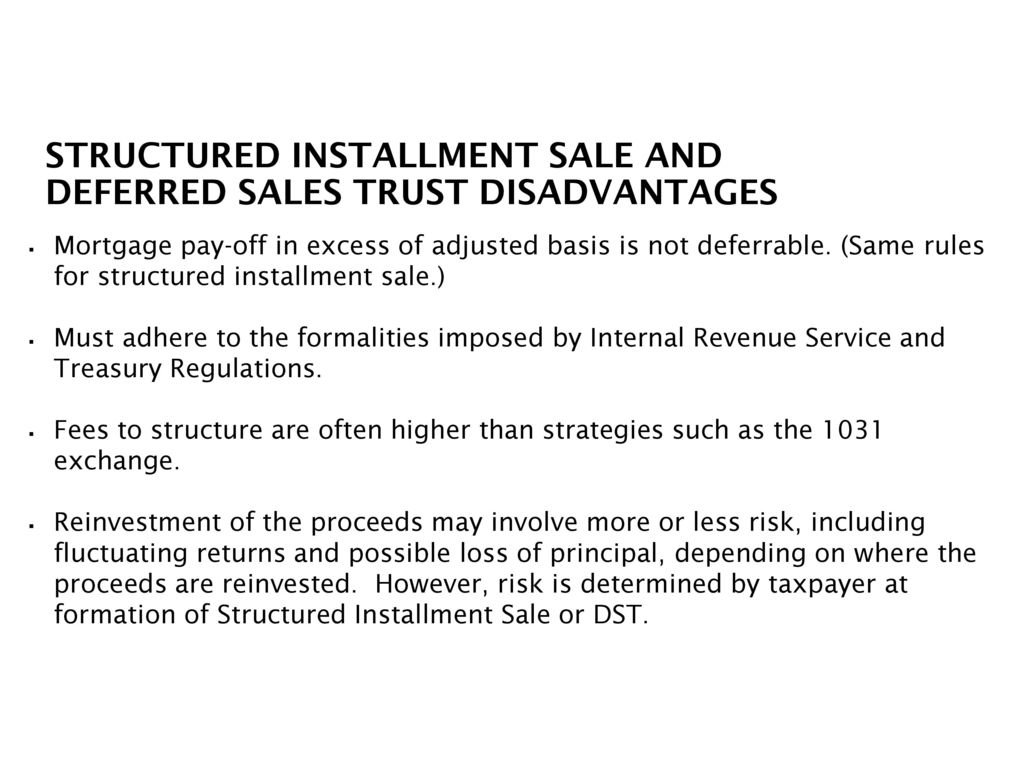

Fees to structure the Deferred Sales Trust are often much higher than other income tax planning strategies such as a 1031 exchange. DST Cons As stated the DST is not for everyone.

Rental Property Exit Plan The Deferred Trust Sales

We will explore why so many high net worth individuals are leveraging.

. Cons of Deferred Sales Trust. The primary benefit of deferred sales trusts is. Deferred Sales Trust Pros Cons.

Are you interested in becoming a deferred sales trust expert. And the Deferral Sales. Estate Planning Team provides exclusive access to market our proprietary capital gains tax deferral strategy the Deferred Sales Trust.

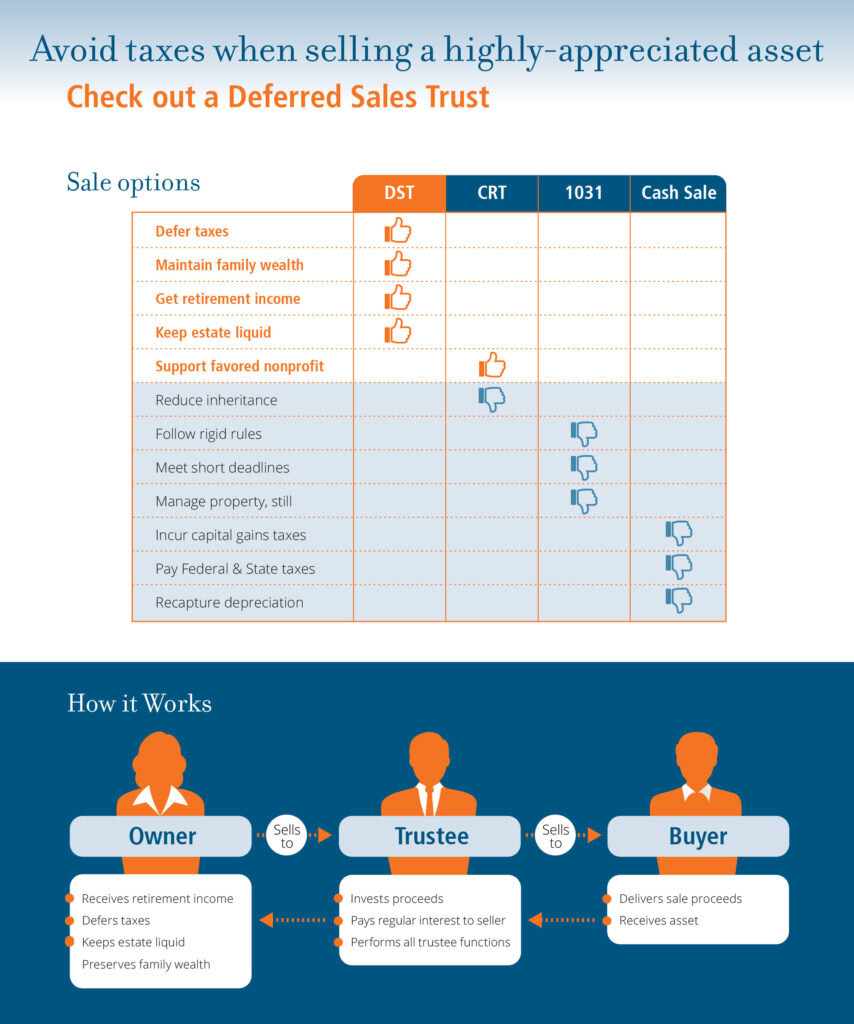

Every investment has risk and can be lost. A 1031 Exchange also known as a tax-deferred exchange is a common fairly straightforward strategy that affords significant tax advantages to commercial property. With a Deferred Sales Trust DST you sell your property outright.

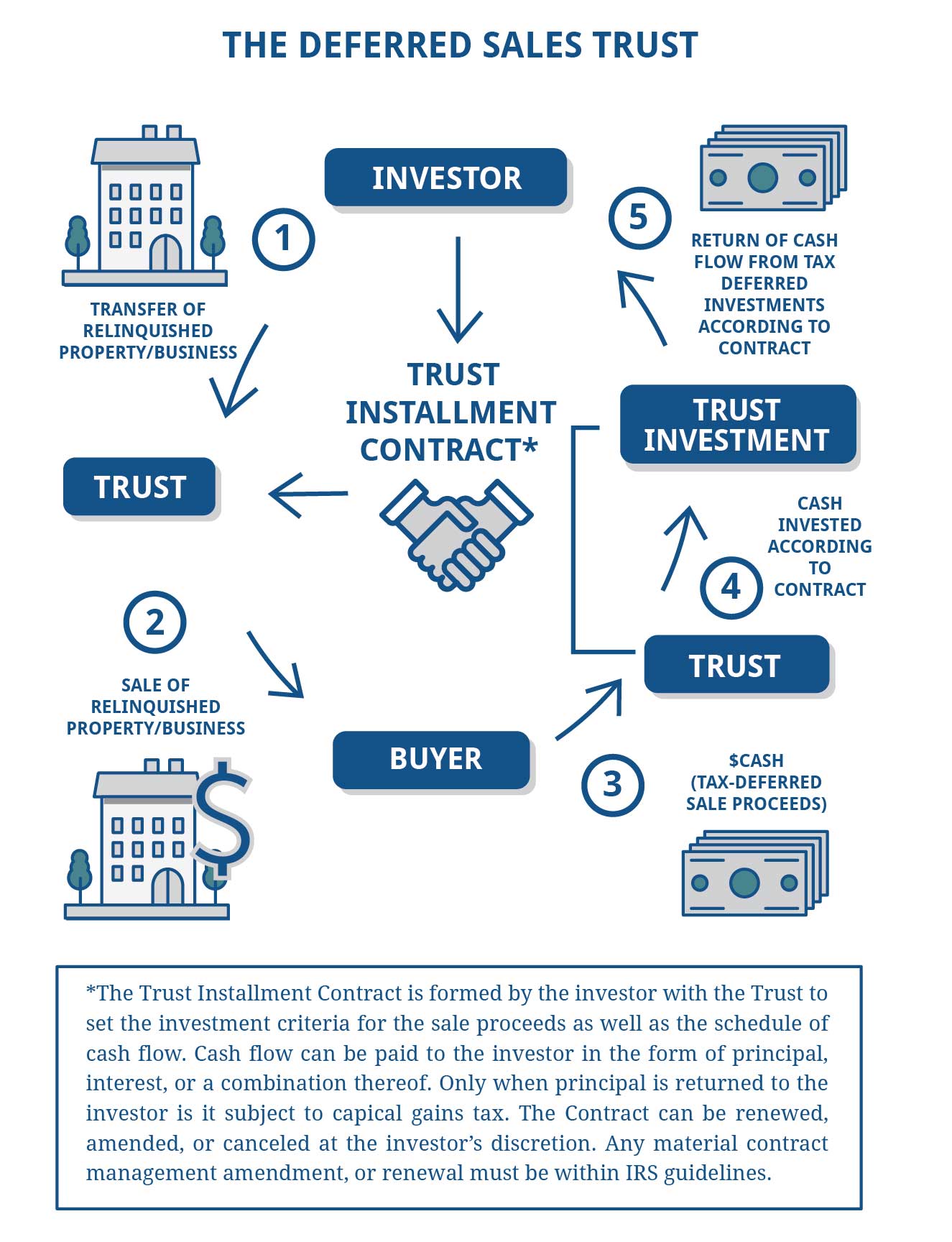

A deferred sale trust is kind of like selling on an installment but without the default risk. Deferred Sales Trust. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a.

You need to face a 250000 or greater gain on your sale with a resulting tax payment of at least 80000 for the DST to be. A deferred sales trust can be difficult to launch and. With over 20 years in business Estate Planning.

In this video were going to take a look at the pros and cons of deferral sales trust. The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031. Thats where the Deferred Sales Trust comes in.

Complex to Set up. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. Let us conclude by discussing some of the pros and cons of deferred sales trusts.

Only few tax-deferral programs are easy to set up due to the complex guidelines associated with them. The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time. Deferred Sales Trust Pros and Cons.

Potential Disadvantages of Deferred Sales Trusts A couple of possible pitfalls with deferred sales trusts include. Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated.

Pros And Cons Of A Deferred Sales Trust Part 6 Youtube

Deferred Sales Trusts Modern Wealth

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

The Deferred Sales Trust Part 2 Ameriestate

What This Course Is About Ppt Download

What Is A Deferred Sales Trust

Pros And Cons Of A Deferred Sales Trust Part 2 Youtube

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trust O Connell Investment And Insurance Services

![]()

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust Crazy Sh T In Real Estate Capital Gains Tax Solutions

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Income Annuity Examples Payouts Pros And Cons

An Ideal Alternative To The 1031 Exchange The Deferred Sales Trust With Brett Swarts

Cpa Services Archives Credo Cfos Cpas

62 Various Aspects Of Deferred Sales Trusts With Greg Reese

Deferred Sales Trust Introduction Jrw Investments

![]()

Deferred Sales Trust Crazy Sh T In Real Estate Capital Gains Tax Solutions